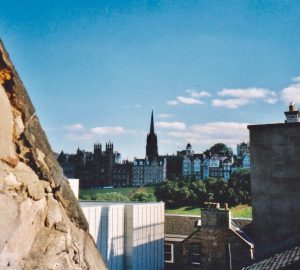

This cyber companion to the second edition of The International Wine Trade was launched in September 2000 from a small attic flat in Edinburgh’s New Town. It has now changed orbit to serve as a platform for all my books.

***

span-e@span.ch

Born into a family of wine brokers in Switzerland, I received a classical education and studied economics, business and law, gaining a Ph.D. in Business Economics from HEC-Lausanne (1978), an M.Sc. in Agricultural Economics from UC Davis (1980) and a Ph.D. in Agriculture from the University of Newcastle upon Tyne (1986).

Past positions and appointments: Research Associate at the Edinburgh School of Agriculture and the Scottish Agricultural College in Edinburgh (1989-1993), Visiting Research Fellow at the School of International Politics, Economics and Business of Aoyama-Gakuin University in Tokyo (1991/92) and Expert to the Economic Commission of the OIV in Paris (1996-2000).

I have operated as a freelance researcher and consultant since 1994, providing consultancy and policy advice on wine marketing and trade issues to senior executives at administrative, intergovernmental and business level.

ARTICLES, MONOGRAPHS AND OTHER PUBLICATIONS

“Wine and Economics” and “Globalisation” – entries in The Oxford Companion to Wine (3rd ed., edited by Jancis Robinson), Oxford University Press, Oxford, Sept 2006.

‘The EU Column’ (monthly), Harpers Wine & Spirit Weekly, London, January-June 2001.

Bilateral Trade Patterns in the World Wine Market, 1988 to 1997 – A Statistical Compendium (with Nicholas Berger and Kym Anderson), CIES, Adelaide, 1999.

‘World Wine Developments in the 1990’s: An Update on Trade’. CIES Discussion Paper No 99/10, May 1999.

‘Suisse et échanges internationaux’, Revue Académie Suisse du Vin, No 32, May 1993.

‘Vers une consolidation de l’économie viti-vinicole suisse’, Revue Economique et Sociale, March 1993:41-59.

‘Producers’ entitlement guarantees: a serious option for liberalising Japan’s rice industry’, Food Policy, August 1992:298-307.

‘Le marché suisse des vins et ses enjeux – Repli?’, Le Courrier du Vin, No 42, Dec 1991.

Viticulture suisse: quel accord? (with Tony Stampfli), Imp. Juris, Zürich, 1990 (reprinted in 1992).

‘Wine budget stabilisers: a question of true balance’, Food Policy, April 1990:167-72.

FRED’S AND THEO’S LOGICAL VIEWS ON RISK

Risk was a hot topic for Swiss wine brokers Fred and Theo during the sixties. The extent to which prices could change after each harvest, despite a concerted effort to contain them with a stabilisation agreement, seemed to surprise them every time. Price instability lay at the heart of Fred’s and Theo’s daily attempts to bring their clients – producers and negociants – to review their price expectations in order to agree a deal. The two brokers felt that stable prices were in everyone’s interest but that it was the wine buyers who were generally more averse to risk and thus keener to see price variability reduced.

These recurrent discussions on the (ir)rationality of wine price adjustments and on the desirability-but-impracticability of price stabilisation took place in the office which my granduncle and my father shared below our flat. I used to spend a lot of time there as a teenager. The conversations gave me an insight into what price variability – risk – meant in practice. The numerous records they kept of wine prices, harvest size, even weather-related events, infused me with a natural feel for numbers. I have fond recollections of the wine brokerage business back in those years, and particularly of the yearly visits paid by a few major clients from Zürich whom Fred would regularly arm-twist into rewarding me with pocket money for good school marks. One of them was Ueli Prager, founder of Mövenpick, pioneer of standardised gastronomy and a key ally to Robert Mondavi.

Fred dearly wished … more

***

Market intervention is coming back into fashion. It was a big economic and political issue since the turbulent 1930s. The policy of stabilising wine prices and regulating trade was adopted by Switzerland and by France who later extended it to its European partners. It was the topic of my first books – on the Swiss market (Le marché des vins en Suisse) in 1978 and The Common Wine Policy and Price Stabilization ten years later.

The EU’s wine policy was fundamentally flawed at the time: price stabilisation having degenerated into price support, this kept pushing down quality, consumption and ultimately prices, in a perverse effect. Ever-growing surpluses were produced and partly dumped onto the international scene, where the EU was a dominant player. … more

***

ARCHIVES & TOOLS: the material previously published on this website has been rearranged in three different sections. Section I features ‘Earlier Thoughts’ (opinions I aired under the ‘Free Thought’ banner until 2011) and a selection of my Harpers columns (2001). These pieces mostly deal with international wine trade and market imbalances (surpluses). Section II offers a short note on the related issue of globalization – with links to wine surveys by The Economist’s (1999) and the WTO (2023). Section III gives you access to a Companion Bibliography on Wine Economics and a French-English & English-French Dictionary of Wine Economic Expressions (WEE).

***

ON PERCEPTION, ATTRACTION AND CHOICE (Exploring the Depths of Wine Consumers’ Souls): The idea for this piece was triggered by the providential encounter with a modern translation of Aristotle’s Traité de l’âme (On the Soul) by Ingrid Auriol and a handful of other books that truly captivated me, including: Stephen Genko’s Intuitive Marketing, Peter Earl’s Principles of Behavioral Economics, Charan Ranganath’s Why We Remember, and Bear’s, Connors’ and Paradiso’s opus on Neuroscience (September 2024).

***

ON ONE’S ATTRACTION TO BEAUTIFUL MODELS AND MINDS (A Very Short Critique of Mainstream Economics): Steven Buccola’s latest book, How Economists Think – A Kantian Interpretation of Mainstream Economics, is the inspiration behind this piece. I became acquainted with philosophy at high school and have remained passionate about it. We do have free will but also display ‘bounded rationality’ – a radical departure from the ‘rational agent’ posited by mainstream economics. Should we still stick to the neo-classical model and its quaint metaphors? (May 2025).

***

WINE FUTURES: Waning price support, rising financial instability and recurring natural hazards warrant the need to provide wine professionals with some means of hedging their incomes against price volatility (risk). The best way to achieve stabilization is through openly traded price contracts, and wine futures happen to be one of them. Careless wording has left many people confused about what they really are – or were. This article provides a few definitions and illustrations of this powerful (and therefore controversial) financial instrument.

***

I hope this cyber companion has served its purpose well, acting as a little independent voice, beaming down an often solitary message from that ‘cold, peaceful space in which the stars revolve’ (Hermann Hesse).

My warmest thanks to Janet MacFadyen and to Neil Wenborn.

***