O-N-E WORLD

The huge, unrelenting contraction of domestic consumption in traditional wine-producing countries and simultaneous development of new markets afar has raised the share of international trade from 10-15% of world demand in the 1960s and 1970s to about 20% in the late 1980s and early 1990s. That ratio shot up to a quarter in the mid-1990s and today nearly every third bottle drunk on earth is imported.

Wine’s increasing reliance on foreign consumers and trade is altering its production and marketing in a profound way, as well as the rules policing wine markets, which were conceived mostly in the earlier part of the 20th century, in Europe, in a major backlash against economic liberalism. International trade used to take place in bulk and around its old Mediterranean cradle. It is now occurring mainly in bottles and slowly drifting towards the shores of the Pacific.

Sourcing is done in an increasingly direct fashion by ever more powerful and internationally active food retailers who have succeeded in bypassing wholesalers’ bottleneck and are responsible for turning wine into a regular item in shoppers’ trolleys. As for the end product, it has become more of a lifestyle item, with its bag of trends and fads, brands and other key attributes bundled together to appeal to ever more demanding but also fickle consumers.

SUPPLY, DEMAND AND TRADE

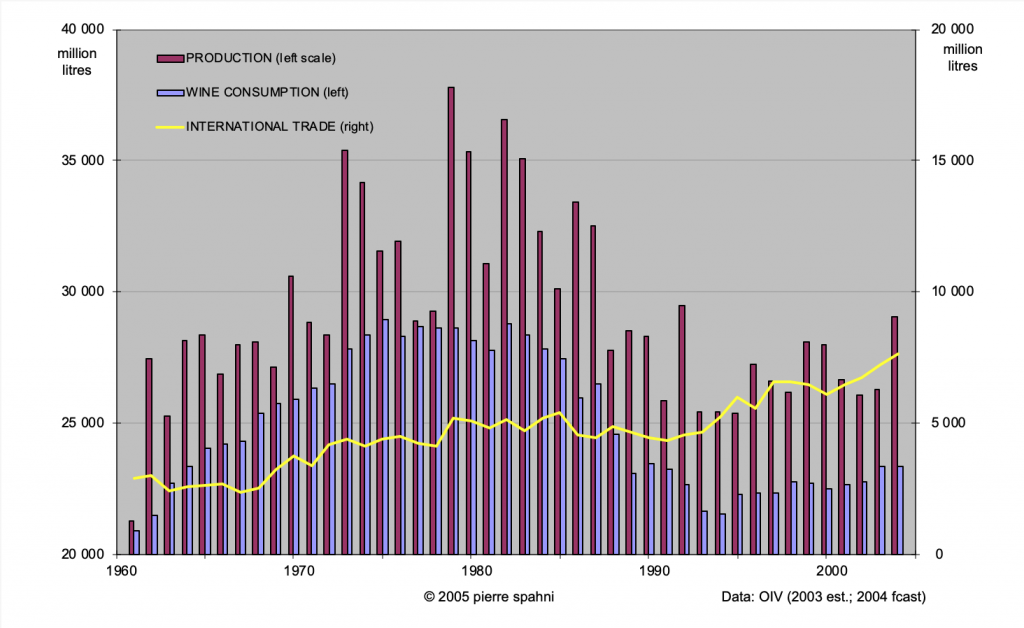

Figure 1

DEMAND (North- and Eastbound)

Consumption has risen steadily for three decades after the Second World War in all key markets except France, which started to contract in the mid-60s. World demand levelled off when growth petered out in the other large domestic markets of Italy, Argentina and Spain, and was pushed into outright recession as soon as these huge markets started their descent in the early 1980s – too big a loss to be offset by a (long-awaited) rise in demand in the Northern parts of the European and American continents. Figures dipped further still when the US momentarily turned its back on wine but bottomed out when a CBS programme ascribed health benefits to moderate consumption in the early 1990s (‘French Paradox’). Resumption of growth in the US, sustained growth in the North of the EU (upon the establishment of a truly free market within its borders in 1992) and the emergence of consumer markets on Asia’s Pacific Rim, China in particular, have since edged demand back above the 23 billion litres mark that used to prevail in the early-mid 1960s and pushed growth back into positive territory (0.8% per annum between 1993 and 2003).

SUPPLY (Southbound – Mind the Gap)

Production typically lags behind consumption by some 3-4 years (the time it takes for newly planted vines to become fully productive) and thus tends to overshoot demand systematically if producers fail to respond quickly enough (as in the case of self-regulating free markets) or when inadequate stabilisation policies are applied. In the EU, the availability of generous subsidies for the distillation of excess wines and premiums for the substitution of old-fashioned grape varieties with more marketable ones, has nursed a permanent production surplus ever since the mid-1970s. The gap between world supply and demand widened recently, in spite of demand springing to life again in the 1990s, as producers in the New World and China kept developing new vineyards in a legitimate response to soaring demand for their wines. Global production stood at around 29 billion litres in 2004. Growth has averaged just over 0.3% pa between 1993 and 2003 and three times that rate if one replaces that small harvest with levels prevailing in 2000 (28 billion litres – standing roughly half-way between 2003 and 2004).

INTERNATIONAL TRADE (Unbound)

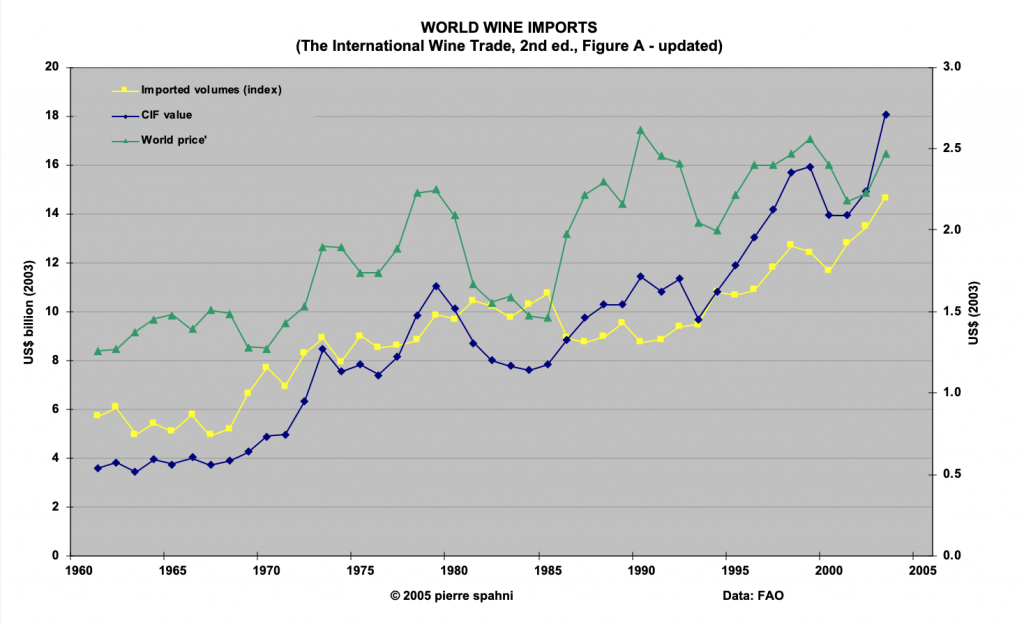

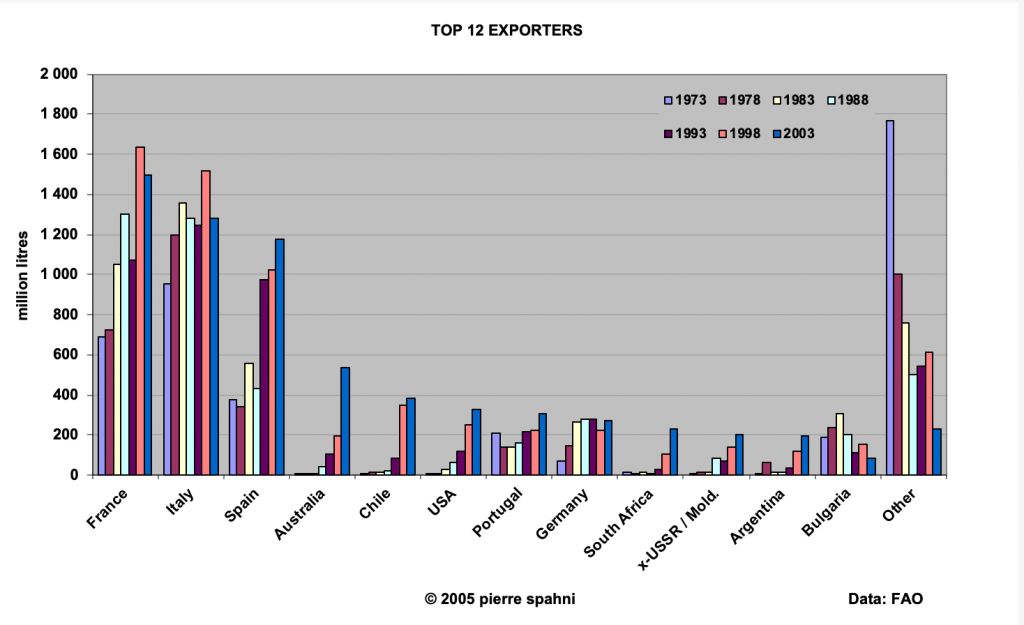

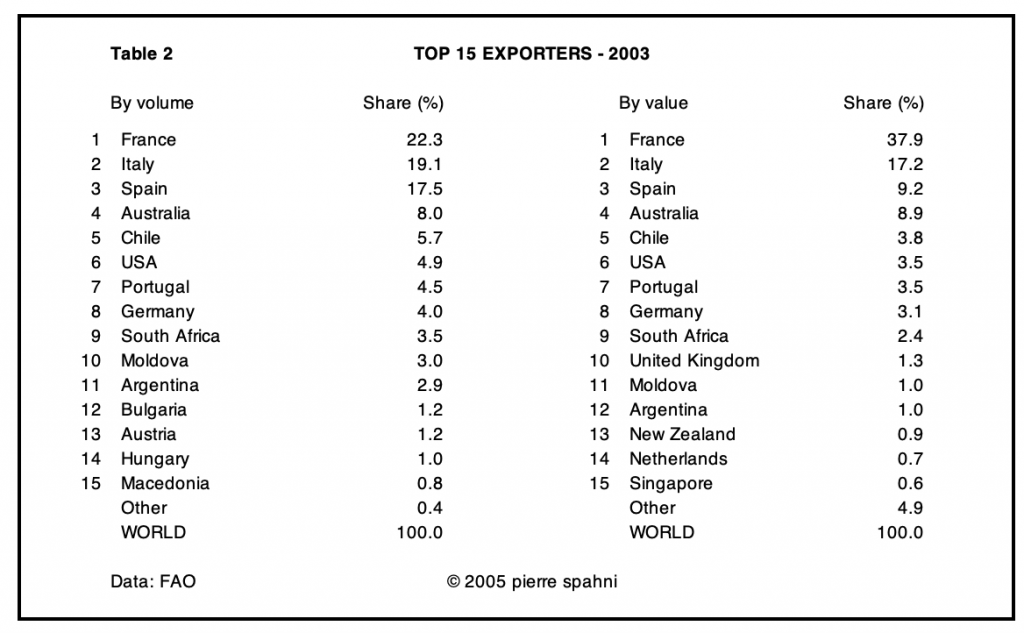

Trade experienced a first serious shock upon the formation of a ‘common’ (yet not entirely free) market for wine in a budding EU and the emergence of the US market back in the 1970s. Germany, Britain and the US helped to lift trade figures until the 1980s when US growth ground to a halt. Volumes were left to stagnate below the 5 billion litre mark until the early-to-mid 1990s, when trade liberalisation delivered a second major shock, first within the EU in 1992 (establishment of a ‘single market’), then on a global scale (GATT/WTO) three years later. Trade volumes were propelled to new heights, clouded only by a millennium hangover (due in part to massive purchases by Asian importers in 1998). Internationally traded volumes have now crossed the 7 billion litres mark, thanks to a sustained growth of 4.5% pa between 1993 and 2003. The real value of imports rose even faster, at 6.4% pa to reach just over 18 billion US$. International trade has increased by a bigger amount in the past 10 years than in the previous 30 years, in value and volume, and the cast of countries aspiring to a leading role on the world stage has been reshuffled accordingly.

Figure 2

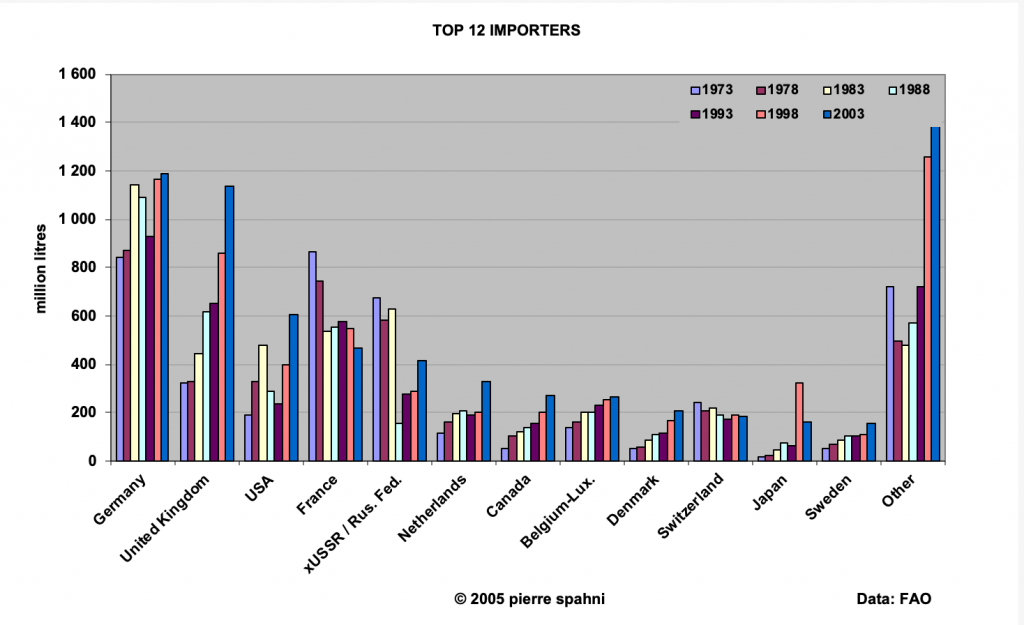

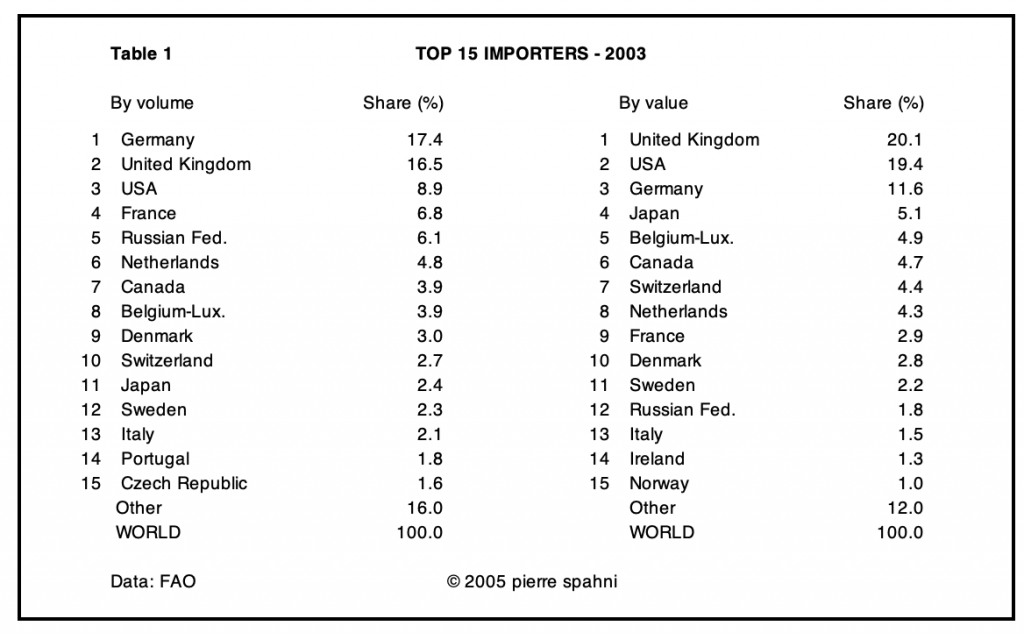

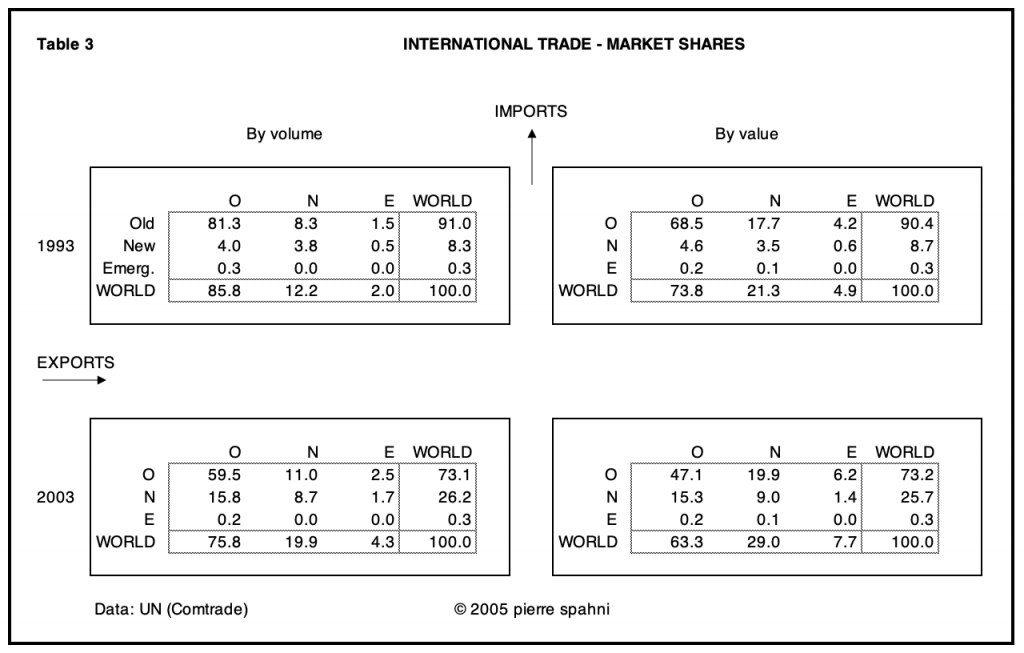

IMPORTS

On the demand side, Germany (which used to be a successful exporter in the 1980s) remains the largest importer in volume but it has since left centre stage to a seemingly insatiable Britain and revitalised US in terms of value, in spite of the major boost provided by German reunification. The former USSR (which has since re-emerged as the Russian Federation) was also pushed into the background in terms of value, behind a blossoming Japan. France and Switzerland are amongst the few countries to experience a systematic decrease in the volume of their imports because of receding consumption and, in the case of France, a much reduced need for cheap bulk for blending coming from Spain – a role held previously by Italy and before that by Algeria which had found itself cut off from the French market through the erection of a trade-protective wall around the EU.

Figure 3

EXPORTS

Most noticeable on the supply side was the demise of Algeria and fellow North African producers since the mid-1960s and, from the late 1980s onward, the fall from grace of Eastern European producers who were hit by the collapse of their state-run economies as well as that of the former USSR around which they used to gravitate. Italy and later Spain (after joining the EU) played their hand well and rose to prominence whilst France reinforced its dominant position in international trade, which is now seriously eroded by more competitive exporters from the New World. Australia, Chile and the US may still lag far behind the European trio in terms of volumes (together they accounted for less than a fifth of trade in 2003) but they are rapidly catching up Spain in value.

Figure 4

ALL IN O-N-E

The beauty with international trade is that it tends to flow both ways, thanks to a diversity in the wines’ attributes (colour, origin, varietal character and winemaking style, packaging and price amongst others) that have turned it into arguably the most differentiated agricultural product of all (read more on wine attributes in either the 1st or 2nd edition of The International Wine Trade).

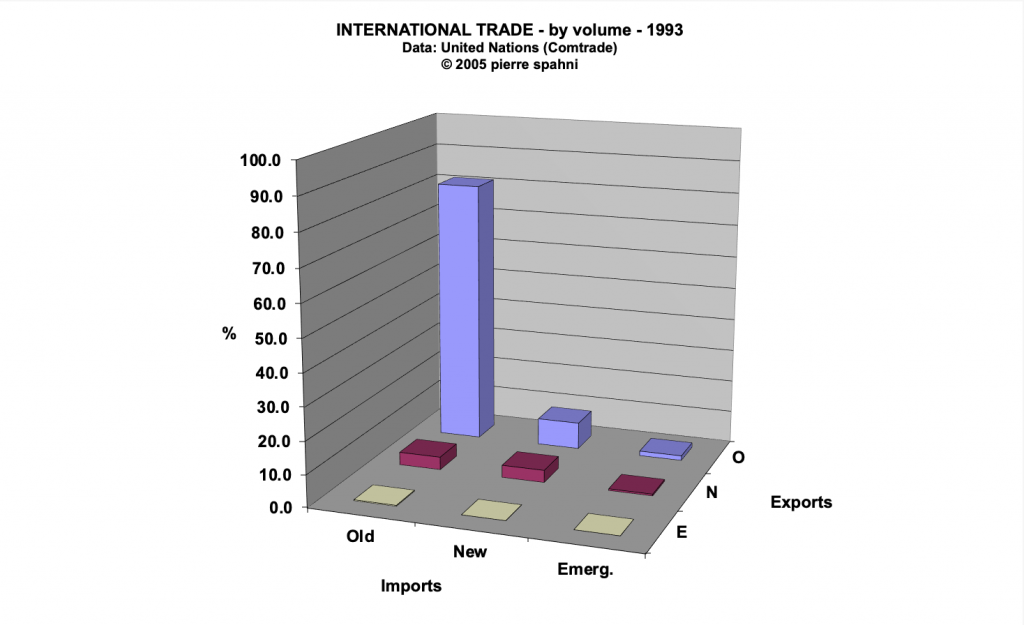

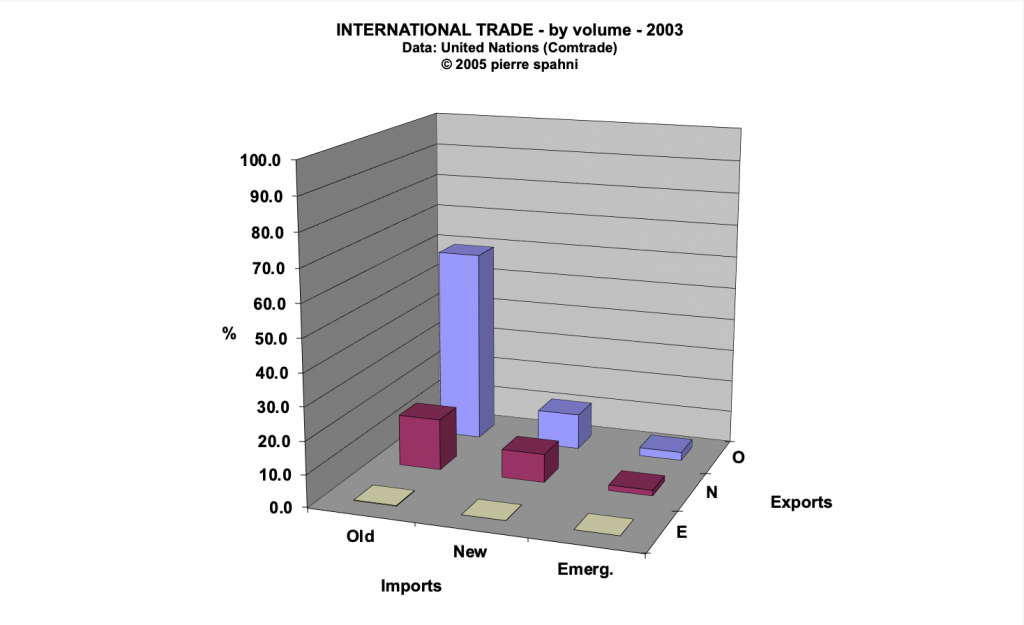

A closer look at individual international trade figures bears witness to a few clear trends over the past 10-15 years, against a backdrop of sustained growth in volume as well as value:

A steady wearing away of the dominant position of the Old World on import and export markets (it lost some 10 and 18 percentage points respectively, in the last ten years, in volume and value terms). But the heaviest losses occurred on its home turf (over 20 percentage points) as Europeans got increasingly thrilled about New World wines.

The powerful advance of the New World as an importer (with a nearly 50% increase on 1993) and soaring exports – it basically trebled its share of the international market in those years. Also remarkable is the success of New World wines in their own region too.

The up-and-coming role of East Asia as a vital importer. Here too New World wines have made significant inroads in places that used to be the preserve of Old World producers/exporters.

Figure 5 (covering about 90% of world trade)

Figure 6 (covering about 90% of world trade)

It is somewhat ironic that the competitiveness of New World wines which EU producers now dread should stem in good part from their being effectively denied access to the European bulk market, which was shut from outside competition by a minimum import price (in all but name) until 1995.

Trade liberalisation sealed within the GATT in the early-mid 1990s gave birth to the WTO, eliminated import quotas by converting them all into tariffs that were then bound to reduced levels by 2001. In the Western part of the Old Continent, the EU offered to drop its minimum-import price and committed itself to reducing export subsidies. The collapse of Europe’s iron curtain and swift expansion of the EU to Russia’s marches was a mixed blessing to wine growers forced to operate a difficult transition from red Scylla to blue Charybdis. New World producers were quick to exploit the opportunities offered by a world opening up to trade, whilst consumers the world over lost no time in enjoying the spoils from increased competition: wider choice and lower prices.

The O-N-E world in which we are all bound to live is still far from ideal though: the EU chose to increase domestic support fairly recently, prompting the US to redistribute ‘promotion dollars’ to help exporters to win over foreign markets. And many an old issue remains unsolved: discussions aimed at protecting geographical indications – a vital attribute for differentiating wines – have been going on for years, with little tangible results, and further cuts in agricultural tariffs have yet to be agreed upon at the WTO. There are also various other initiatives aiming at liberalising trade on a more ‘regional’ basis, such as the New World’s own World Wine Trade Group that is now setting its sights on Asia. Rising US ambitions as a leading importer as well as a significant exporter have dented the hegemony of France and the EU on the world stage, tipping the balance of power slightly towards an increasingly assertive New World.

The earth is becoming an ever-tinier place where fashions, technology, know-how and capital can cross borders with ease – leading, inter alia, to international consolidation in the production and distribution of wines. Many companies had to outgrow their national market because of falling domestic sales and a few large international wine companies and brands have emerged that are built on economies of scale.

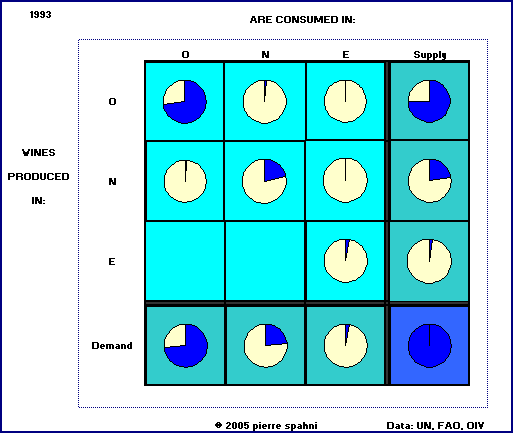

Adding demand for locally produced (indigenous) wines to import figures gives perspective to Figure 5. The past ten years have jolted the dials on flying marketers’ instrument panels, which used to read like this in 1993:

Figure 7

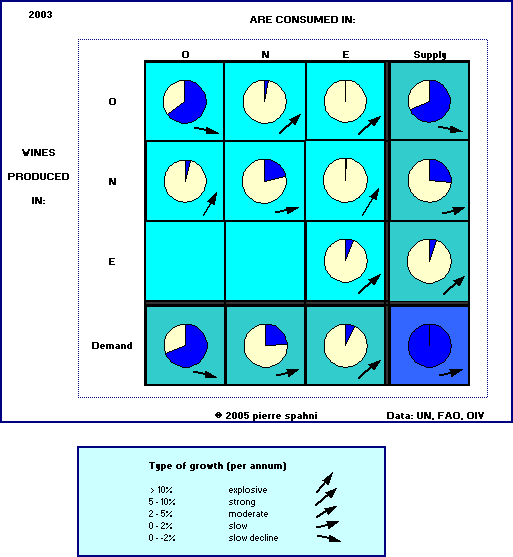

… into something looking like this in 2003:

Figure 8

NOTE: Old, New and Emerging Worlds are aggregated from a 14×14 world regions trade matrix originally developed for the mid-late 1990s in the 2nd edition of The International Wine Trade. In this much simpler 3×3 model, the Old world covers Europe (the EU_15, the Rest of Western Europe, Central & Eastern Europe, the former USSR) and North Africa; the New World combines North America with the globe’s southern hemisphere (NAFTA, Mercosur, the Rest of Latin America, the South African customs union, the Rest of Africa and Oceania); whilst the Emerging world bundles the Asean_9 countries with the Rest of Asia and the Middle East. Please see Chapter 7 of The International Wine Trade (2nd ed., Woodhead Publishing, Cambridge, 2000 and China Import Publishing, Beijing, 2003, pp 330-1) for a full description of the regions concerned

Looking down the grid and summing up the various segments gives the consumption of each ‘world’, whilst adding them up across yields the origin of the wines effectively consumed on earth, net of any production surplus.

Growth indicators – the arrows – refer to the size of the individual markets in volume (not to the shares themselves). Old World producers for instance, saw their cut of the world market dip from 75 to below 70% whilst volumes decreased at a yearly rate of less than half a percent. More or less the same happened on the demand side, where the Old World’s share slipped whilst sales went into gentle decline (slight negative growth).

And conversely for the New World which posted increases across the board except on its home ground where sales growth was hampered by falling demand in Argentina. The New World now contributes to about a quarter of the volumes supplied and demanded worldwide, owing to the soaring success of its wines on export markets.

To find healthy growth elsewhere, one really needs to turn to Asia’s Pacific Rim. The New World rose to international prominence as a vital importer before daring to harbour exporting ambitions of its own. Will emerging Asia follow a similar path?

June 10th, 2005

© 2005 pierre spahni / www.span-e.com.

You may quote or disseminate this article provided you make full reference to its author and website.